In the startup world, innovation is key, and that is true for every aspect of this thriving industry. For AdFirst, a co-investment VC that uses marketing expertise to invest in early/expansion stage start-ups, utilizing novel and ingenious strategies has been a key part of the company’s success. To get a better understanding of how this VC sets itself apart, we spoke with Oleg Dronov, COO of AdFirst.

I understand AdFirst is a co-investment VC. Can you explain how this is different from a traditional investment fund?

Our key point is that we know marketing well. We offer our expertise to other funds and make it possible to test projects for marketing competencies. In exchange, we take their expertise in the classic DD formats and supplement them with ours. In practical terms, we work with the funnels of other investors and join their round.

An investor knowing our competencies in the digital mass market (B2C) – sends projects to us for verification. If we are interested in such investment, we conduct Marketing Due Diligence and after that, if it runs good, we make an offer to invest in the company on the terms of the current round. As a rule, we participate in deals on late-SEED or A round projects and take 10 -15% of the amount of the round. The lead investor, in turn, conducts classic due diligence and gets additional opportunities to verify the project from the marketing side.

I also understand that AdFirst uses “advanced and unique techniques to assess each start-ups growth viability.” Can you elaborate on what these techniques are and how they work?

We call it Marketing Due Diligence, we perform ads tests for start-ups and help the investor evaluate the reachable audience, check the marketing competencies of the team, and reduce the cost of attracting customers. Testing allows to confirm the company’s capitalization and eliminate marketing risks.

In the future, we oversee the marketing strategy of the project in order to control KPI. If we go to the details on the test process – we make and proof about 150 marketing hypotheses on how to attract users in 2 weeks and spend about $1000 marketing budget.

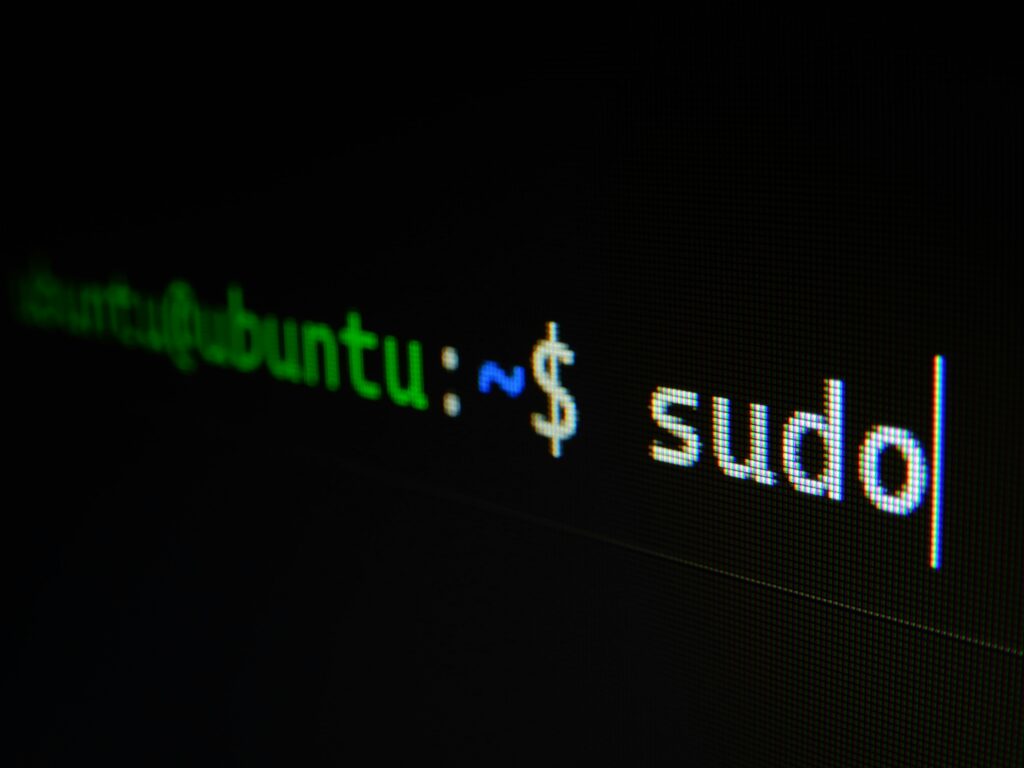

Usually, our test runs for 14 days. Below you can find a transcript of the way we work:

- – A short interview with the founder of the and the investor – 2 hours

- – Analysis of current marketing materials – 1 day

- – Analysis of analytical systems and product pages – 1 day

- – Create a hypothesis (audience – pain – message) – 1 day

- – Preparing creatives – 1 day.

- – Purchase advertising and measuring metrics – 7 days

- – Preparation of reports on the results – 2 days

What do Start Up owners need to consider when entering late seed stage/Series A funding rounds?

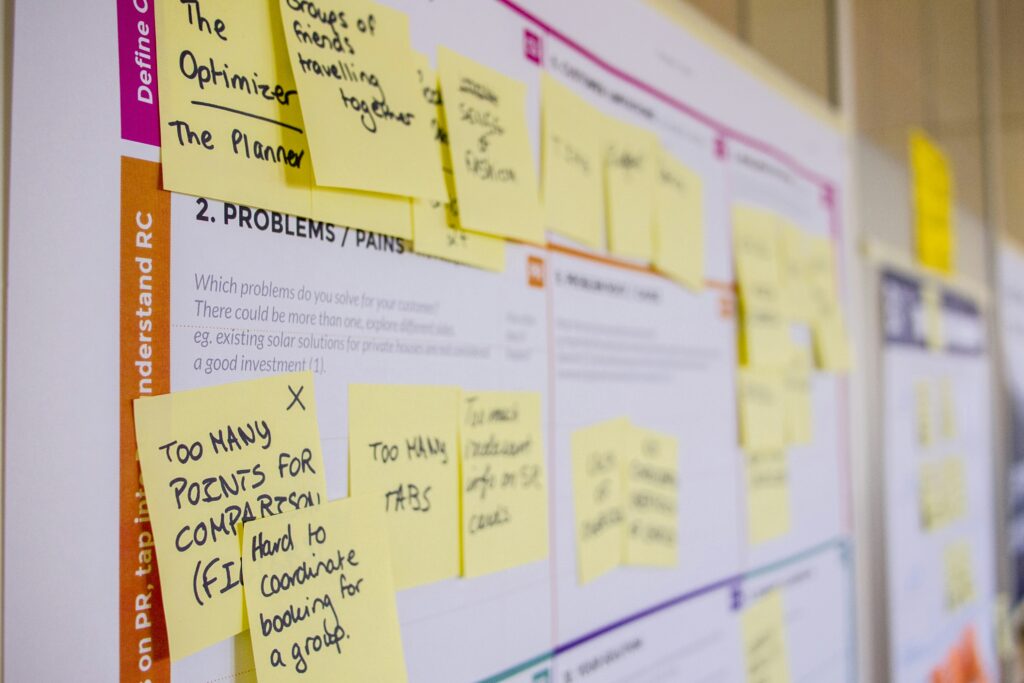

In the course of our work, we were able to to make a kind of a wish-list for SEED and Series A startups:

Firstly they must understand who their client is and create a system of testing multiple lead generation sources. Once that is done, assess the market depth and reachability of the desired audience. Following these steps, they must continuously work on reducing CAC.

Next, search for opportunities and tricks to increase marketing effectiveness. And finally, it is vital that they are constantly experimenting, trying to find new technologies and channels to promote, along with search marketing loopholes and lifehacks.

Aligning the value is essentially a procedure consisting of 2 main aspects: The value that the project brings to the customers and society as a whole, for us, this value is key in the basic selection of startups. We must feel it, what needs the project solves and, based on this, make a decision to do MDD.

How necessary is total value alignment between investors and investees?

The value that the investor adds, helps the project to grow, is not always about the money. Often, investors help to startup with valuable advice, strategic assistance, legal side or marketing expertise – as in our case. I believe that the project and an investor always equalize this value. So we as investors become part of the startup team and the partners as well. A partner can only be the one who adds value to the project.

What is the optimal level of involvement with investors/investees?

Speaking about us, we help all our portfolio projects with the marketing strategies, as this is a rather important competency that affects the development of the project. As a rule, monthly meetings with the project enough for us – although there are situations when our advisers help with the launch of a new product, and then this requires more involvement.

Disclosure: This article includes a client of an Espacio portfolio company